how to change how much taxes are taken out of paycheck

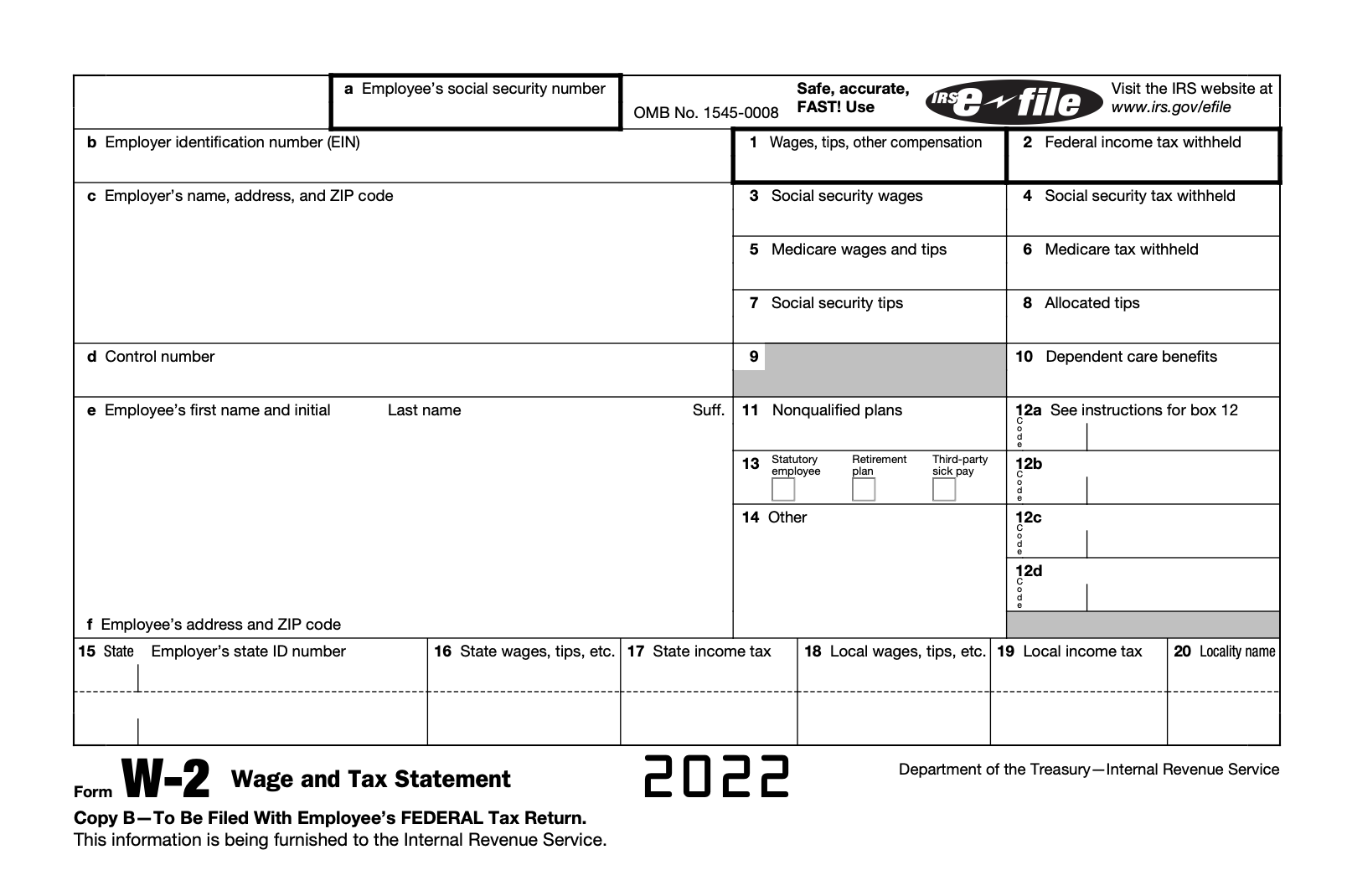

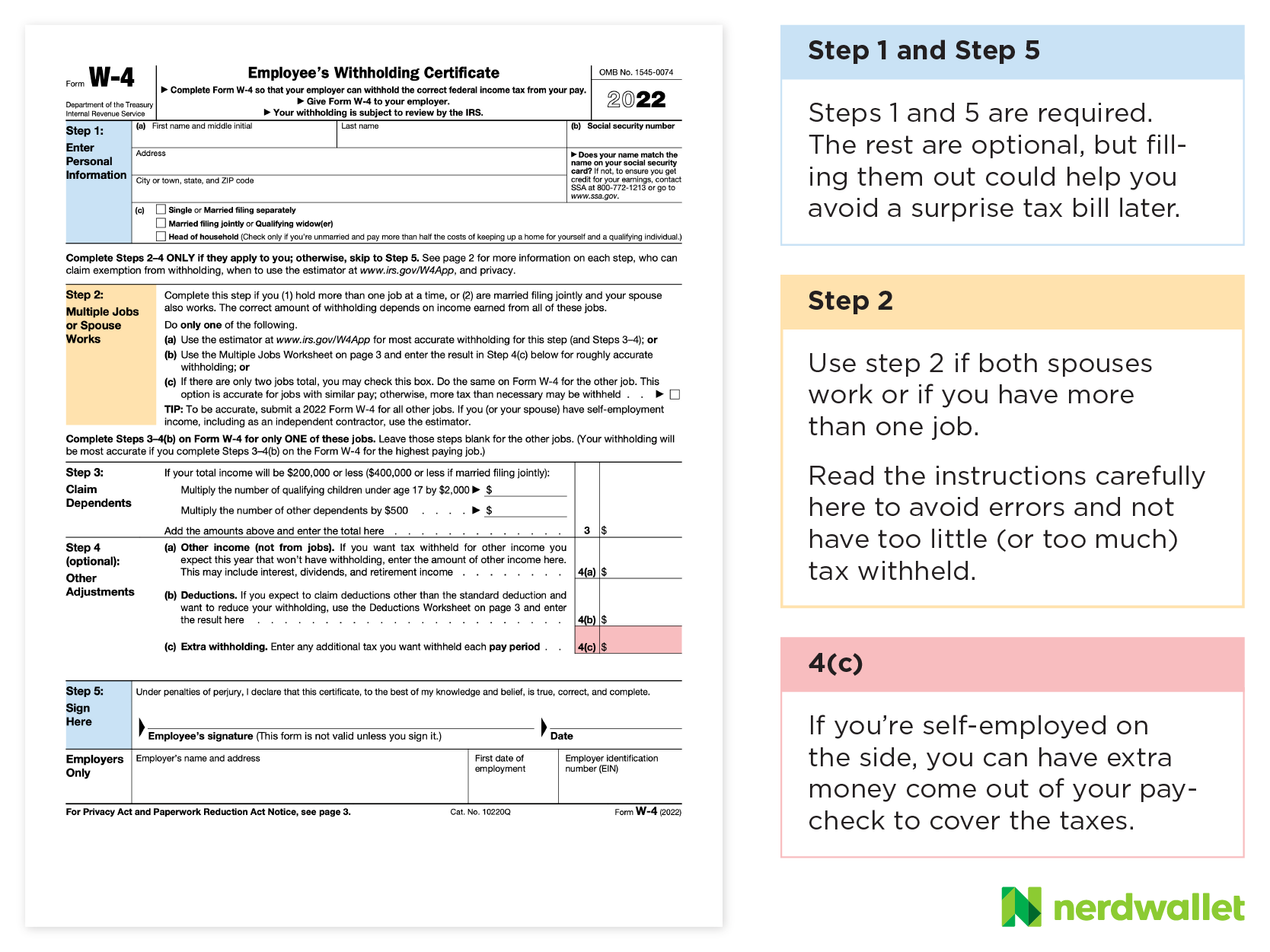

You need to submit a new W-4 to your employer giving the new amounts to be withheld. To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods.

Verify Is California The Worst State For Your Paycheck Abc10 Com

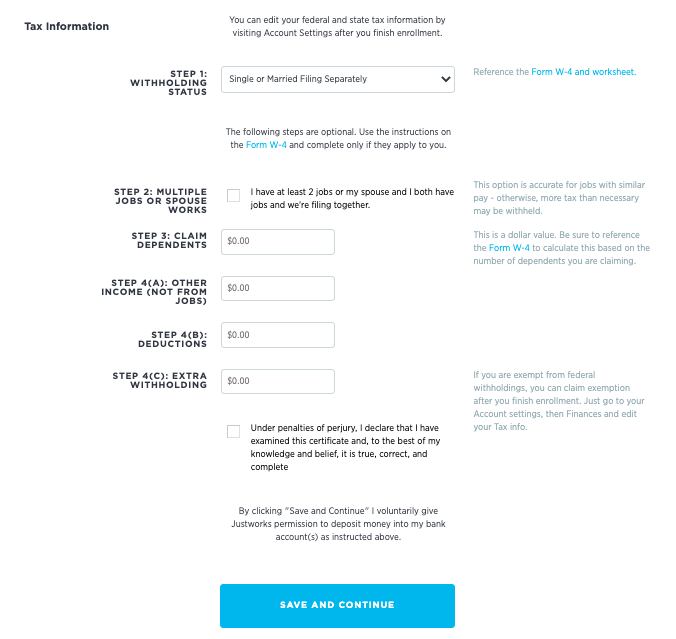

Enter your new tax withholding.

. To change your tax withholding amount. Complete a new Form W-4P Withholding Certificate for. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

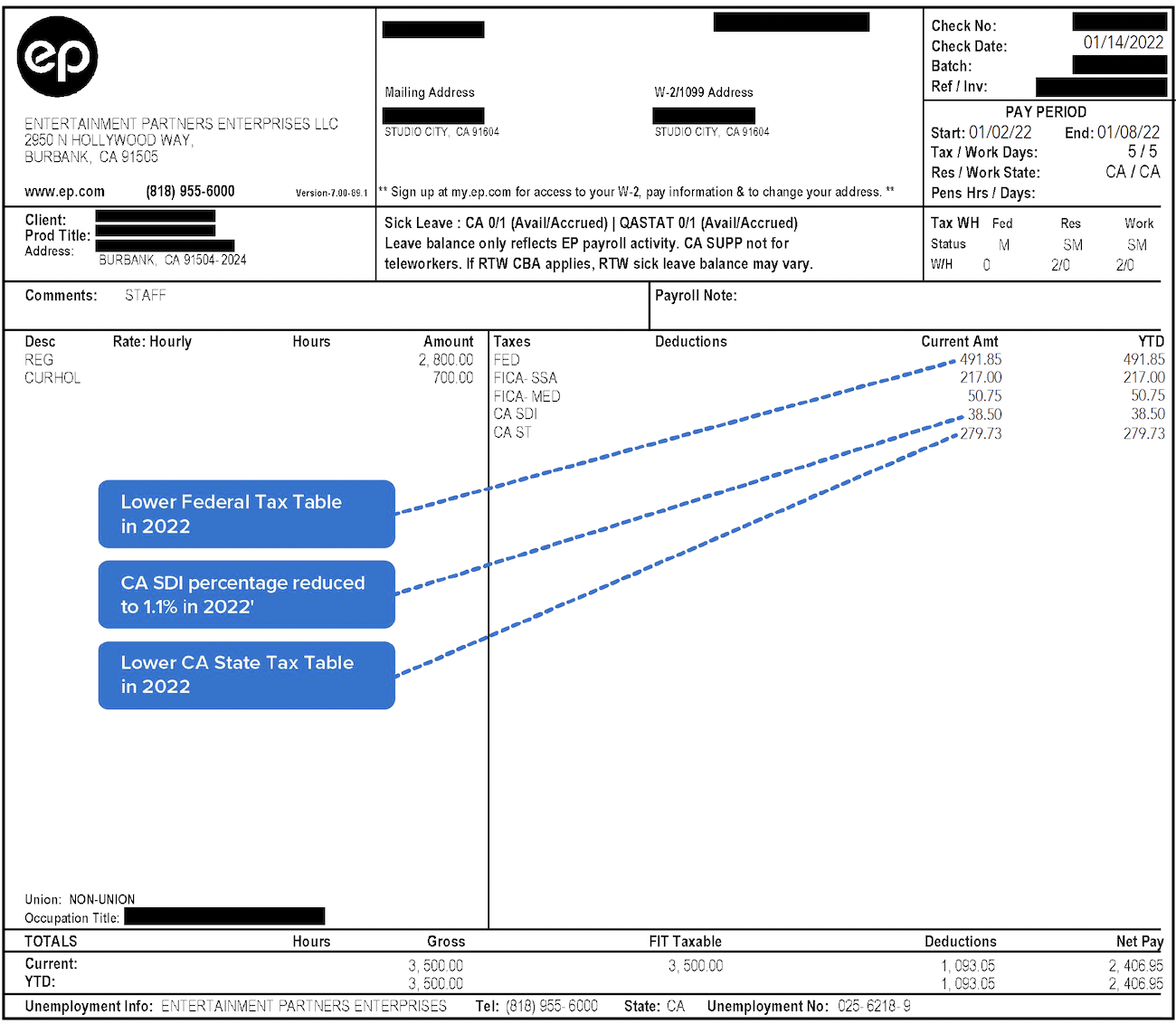

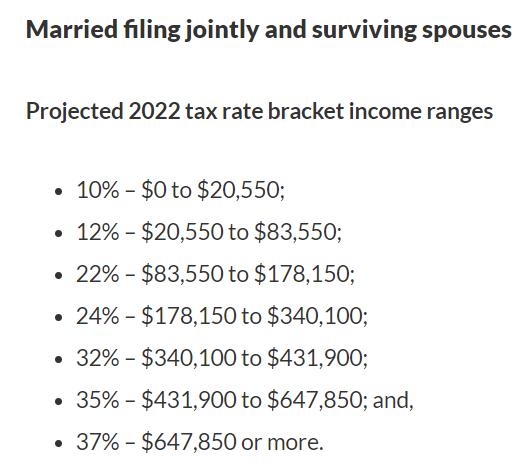

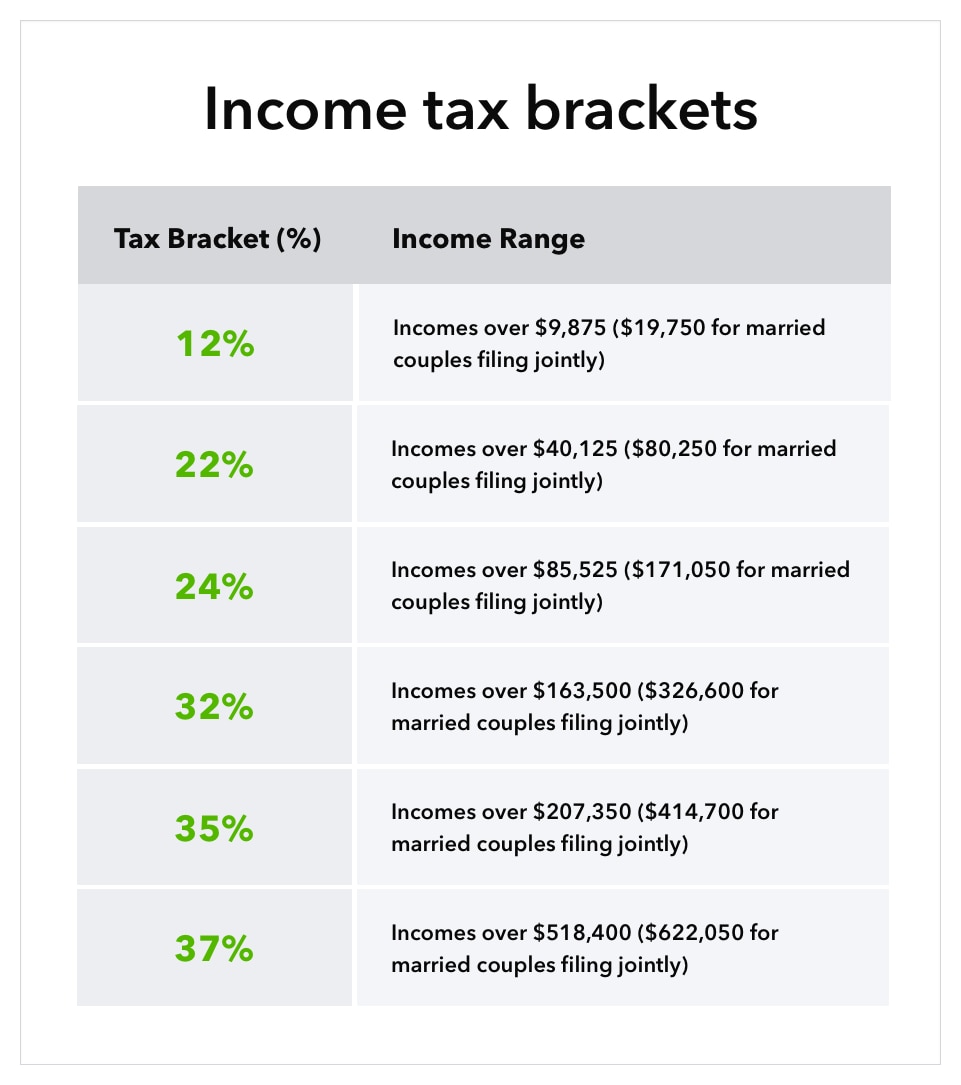

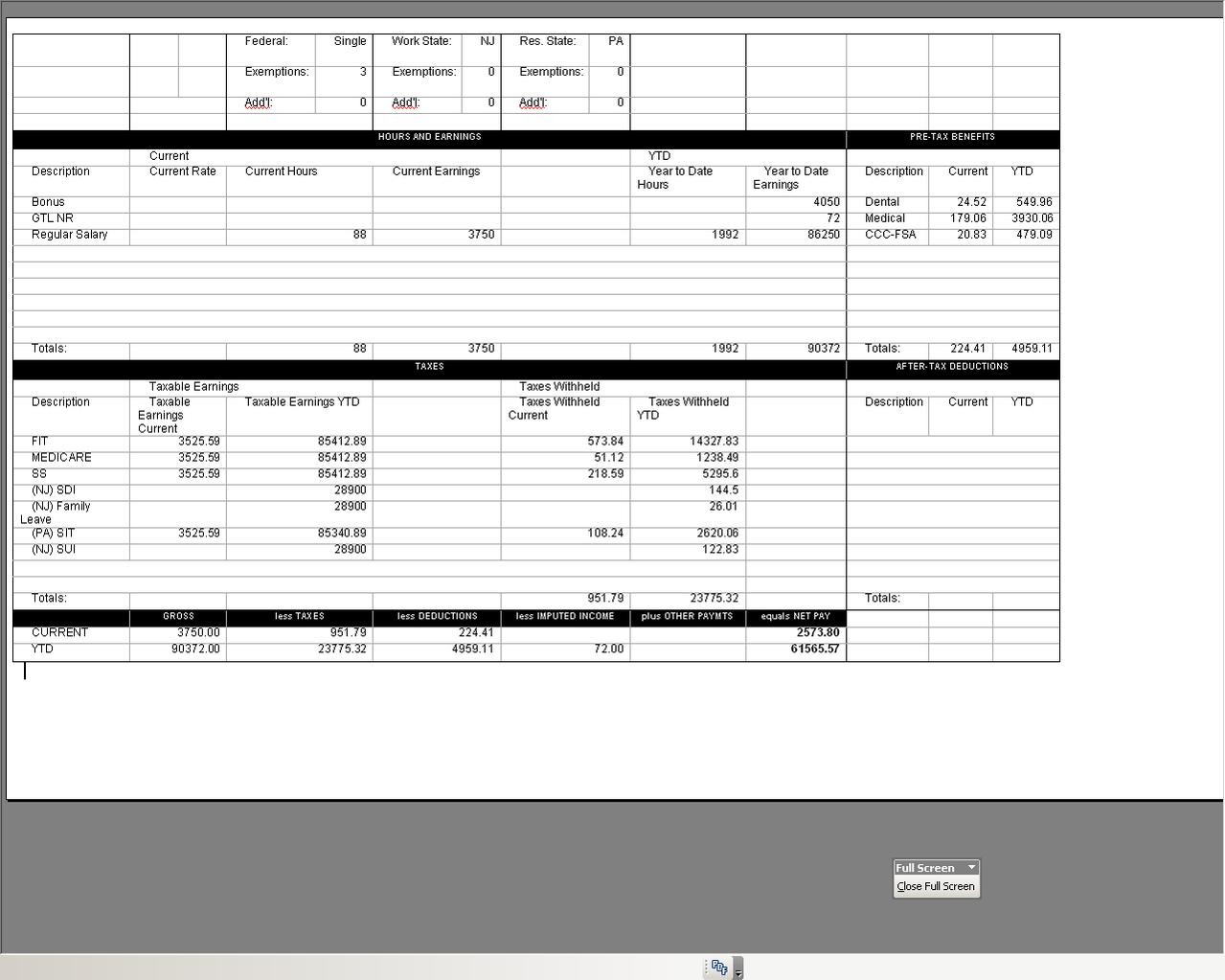

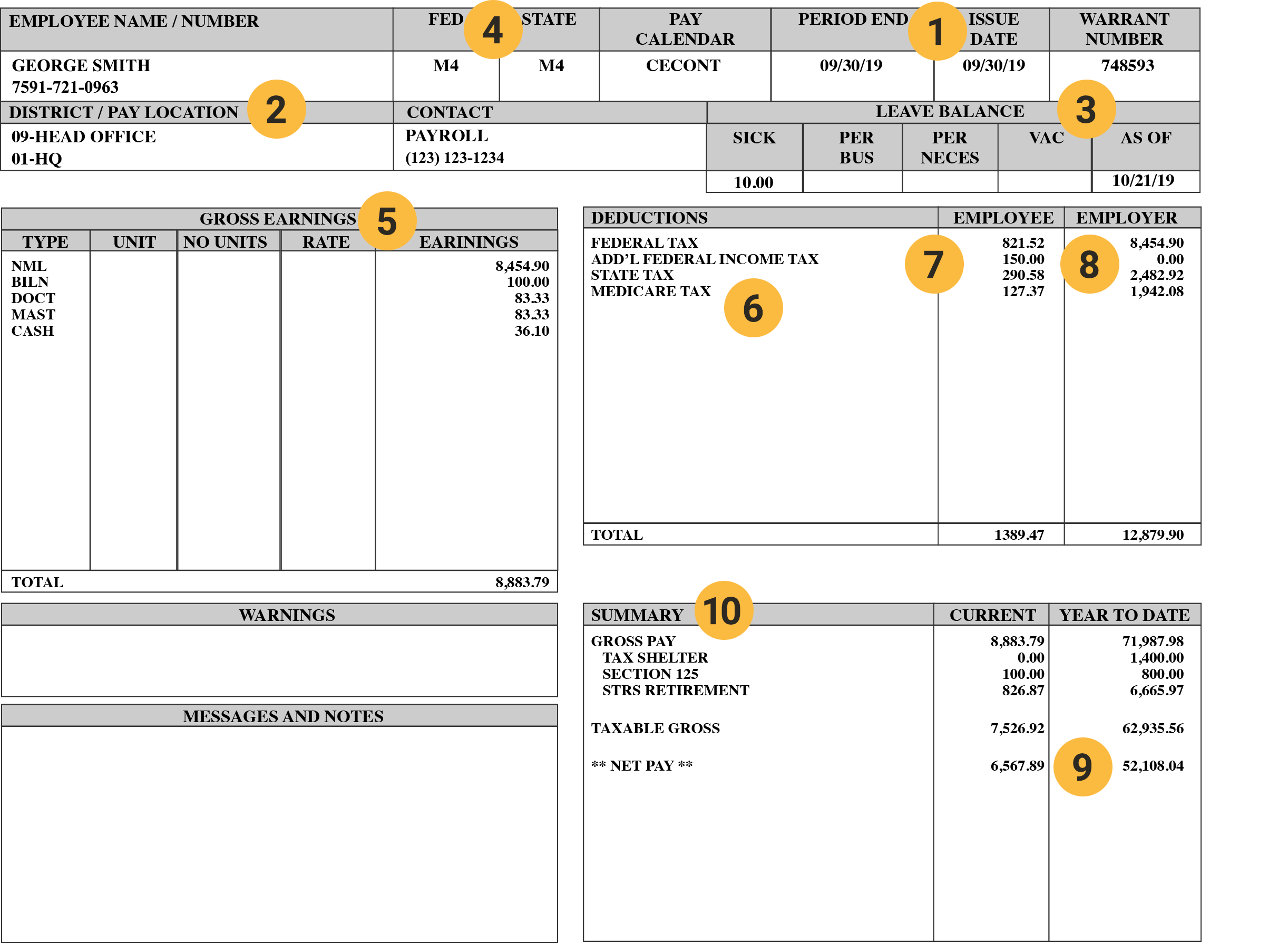

Figure out the take-home pay by subtracting all the calculated deductions from the gross pay or using this formula. Keep in mind that what you see are marginal tax rates but you wont pay that tax rate on the entire amount. If too much tax is being taken.

FICA taxes are commonly called the payroll tax. Now you claim dependents on the. How to have less tax taken out of your paycheck Increase the number of dependents.

Or keep the same amount. What is the Georgia income tax rate for 2020. For a single filer the first 9875 you earn is taxed at 10.

How to Change How Much Taxes Are Taken Out of Paycheck. Next add in how much federal income tax. To adjust your withholding is a pretty simple process.

This is a rough estimate of what. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. Reduce the number on line 4 a or 4 c.

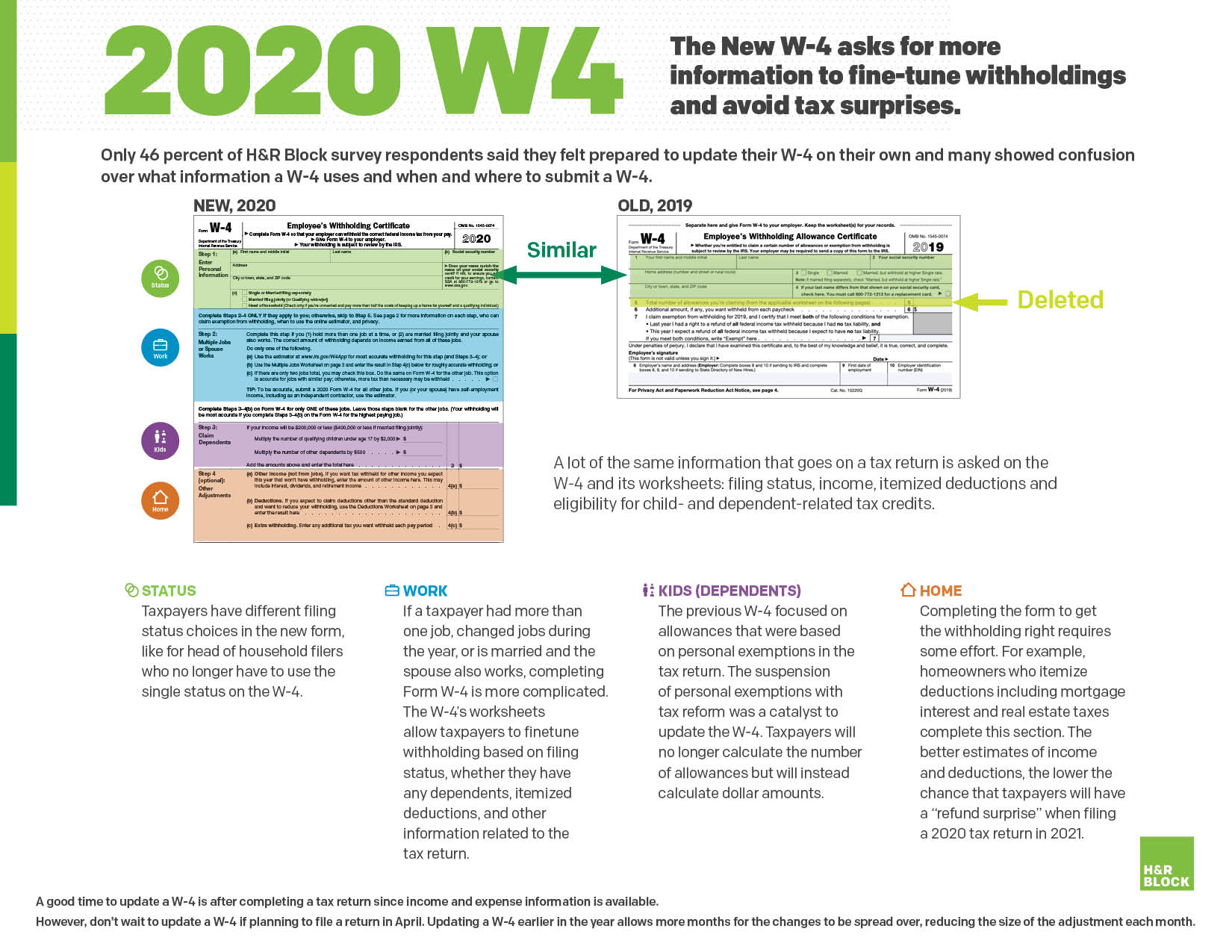

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. For instance if you have 100000 of income. The top Georgia tax rate.

If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the. A Form W-4 officially titled Employee Source Deduction Certificate is an IRS form that employees use to. FICA taxes consist of Social Security and Medicare taxes.

Increase the number on line 4 b. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year. That changed in 2020.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. How To Get A License To Do Taxes Calculating Your Total Withholding For The Year Take your new withholding amount per pay period and multiply it by the number. This is a rough estimate of what.

If you want less in taxes taken out of your paychecks perhaps leading to having to pay a tax bill when you file your annual return heres how you might adjust your W-4. Net pay Gross pay Deductions FICA tax. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

Use your estimate to change your tax withholding amount on Form W-4. However they dont include all taxes related to payroll. Only the very last 1475 you.

To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. How do I calculate the percentage of taxes taken out of my paycheck. Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4.

Questions About My Paycheck Justworks Help Center

Owe Too Much In Taxes Here S How To Tackle The New W 4 Tax Form

What Are Employer Taxes And Employee Taxes Gusto

Decoding Your Paystub In 2022 Entertainment Partners

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Explaining Paychecks To Your Employees

What S The New W 4 And How Does It Affect Me Aps Payroll

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

How To Calculate Payroll Taxes Tips For Small Business Owners Article

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

What To Do When Employee Withholding Is Incorrect

W 4 Form What It Is How To Fill It Out Nerdwallet

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

:max_bytes(150000):strip_icc():gifv()/when-you-can-expect-to-get-your-first-and-last-paycheck-2060057_FINAL-f67a68ad9574474e90ec9e420187640e.png)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)